Allan Katz: Charged by FINRA? The Truth Exposed (2024)

Disputes & Complaints: Allan Katz

These disputes and complaints are often hidden by paid PR articles. This makes it easier for finance professionals to convince clients that they are legitimate. It is unethical to hide the truth from a client and it often leads to major financial losses.

Here are all the client complaints and disputes:

History Of Allan Katz

Katz entered the securities industry in August 1991 when he associated with a FINRA

member firm and registered as a General Securities Representative. From 1991 to 2004,

Katz was registered as a General Securities Representative and/or General Securities

Principal through his association with other member firms. From April 2004 through

May 2020, Katz was registered as a General Securities Representative and General

Securities Principal, and from April 2008 through May 2020, a Municipal Securities

Principal through his association with Royal Alliance Associates, Inc. In May 2020,

Royal Alliance terminated Katz for the conduct described below.

Since June 2020, Katz has been associated with another member firm and registered as a

General Securities Representative, General Securities Principal, Municipal Securities

Principal, and Municipal Securities Representative, and thus remains subject to FINRA’ s

jurisdiction.

Allan Katz Report

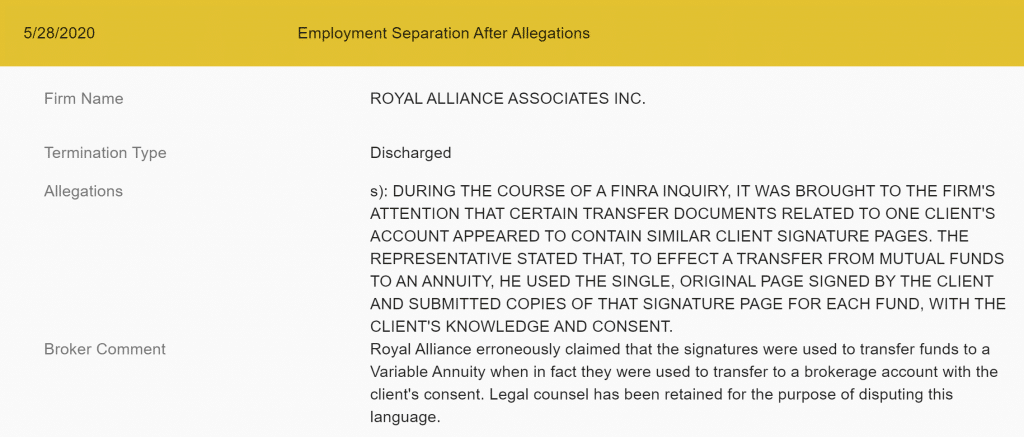

This matter originated from Royal Alliance’s filing of a Form U5 termination for Katz.

FINRA Rule 2010 requires associated persons to observe “high standards of commercial

honor and just and equitable principles of trade” in the conduct of their business.

“Falsifying documents is a prime example of misconduct” that violates Rule 2010.1In

particular, affixing customer signatures or otherwise altering account transfer forms

violates FINRA Rule 2010.

On or about February 20, 2019, Katz recommended, among other things, that his elderly

customer move directly-held mutual funds into two management investment accounts. To

effect those transactions, the customer signed two account transfer forms to transfer two

retirement and nine non-retirement mutual funds into both an IRA and individual

management investment account, respectively.

The mutual fund company then notified Katz that it required separate account transfer

forms for each mutual fund. On or about March 5, 2019, Katz reused the original account

transfer form signature page for the IRA management investment account and

resubmitted it to the mutual fund company on two new account transfer forms. He reused

the original account transfer form signature page for the individual management

investment account and resubmitted it on nine new account transfer forms. In total, Katz

reused the customer’s original signature pages 11 times to expedite the processing of the

transactions.

By virtue of the foregoing, Katz violated FINRA Rule 2010.

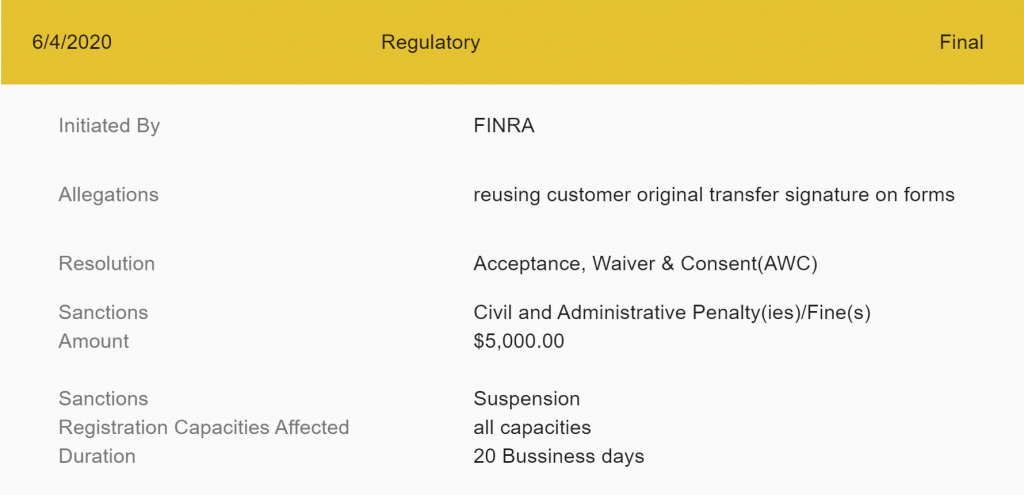

Penalties, Punishments & Sanctions

■ a 20 business day suspension from associating with any FINRA member in all

capacities and

■ a $5,000 fine.

Respondent agrees to pay the monetary sanction upon notice that this AWC has been

accepted and that such payment is due and payable. Respondent has submitted an

Election of Payment form showing the method by which he proposes to pay the fine

imposed.

Allan Katz Review

On or about March 5, 2019, Katz reused an elderly customer’s signature pages on 11

account transfer forms required for one customer to transfer directly-held mutual funds

into two management investment accounts. Through this conduct, Katz violated FINRA

Rule 2010.

How To Spot A Fraud Finance Advisor (Infographic)

Help For Victims Of Allan Katz

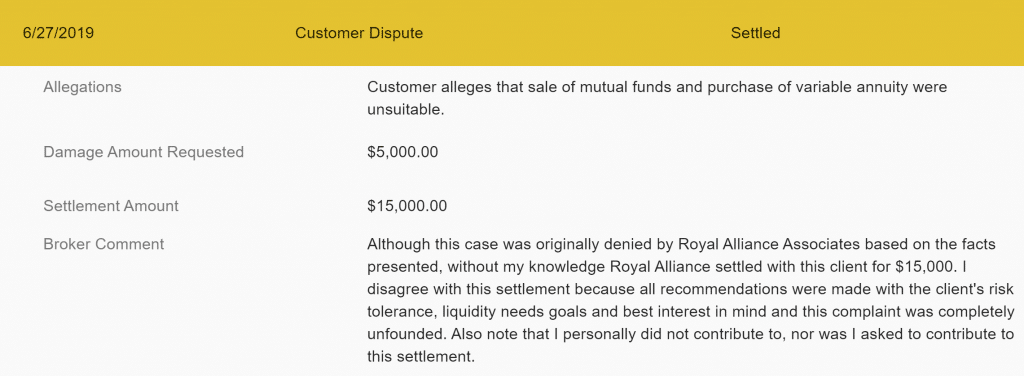

If you have lost funds because of misrepresentation, unsuitable investment, or unsuitable investment strategy from Allan Katz. Then you can take legal action and get justice. Fraud, Malpractice & dereliction of duty should not be taken lightly, especially in this industry. We highly suggest that you notify authorities or seek legal action if your financial advisor or brokerage firm fails to abide by FINRA’s rules are regulations.

How can you spot a broker who is trying to deceive you?

A broker’s credentials, registration, and job history can be reviewed using BrokerCheck, a free online tool provided by FINRA. Disputes with clients, disciplinary actions, and specific financial and criminal matters on the broker’s record are all covered in the disclosure portion of BrokerCheck.

Financial advisors are regulatory & legally obligated to suggest (recommend) the most suitable investments/investment strategies to their clients. Their suggestions should have their client’s best interests and should be appropriate for their client’s goals and needs. Similarly, the brokerage firm which hires financial advisors also has a regulatory & legal obligation to keep a close watch and supervise their Financial Advisors’ practices & behavior. They need to make sure that the financial advisor is not being manipulative or having an unreasonable bias towards certain investments. If the financial advisor and/or the brokerage firm breaches these duties, then the client/customer may be entitled to a full or partial recovery of their losses.

Read more about: General Cannabis Corp

Financial advisors need to have the interest of their clients when giving suggestions related to investments and investment strategies. Reasonable basis suitability requires the advisor to do their best to analyze & identify the risks and rewards associated with their suggested investment and/or investment strategy.